- Our School

- Our Advantage

- Admission

- Elementary•Middle School

- High School

- Summer

- Giving

- Parent Resources

- For Educators

- Alumni

« Back

Are Dyslexia-Related Expenses Tax deductible?

February 3rd, 2019

By Adam M. Domow, CPA

As a certified public accountant, I’ve been asked by many parents of children with dyslexia if they can deduct on their tax returns expenses incurred on tuition, tutoring, evaluations—money spent helping their children learn.

In the United States, dyslexia is considered a medical condition that interferes with a student’s ability to learn, and related expenditures are potentially deductible as medical expenses. Sounds easy enough, right? Not quite, although these expenses are eligible to be claimed as a medical deduction, merely paying the expenditure is not sufficient enough to claim the deduction.

Most taxpayers are familiar with certain itemized deductions, such as state taxes, mortgage interest, and charitable donations. The medical expense deduction, however, might be new to some. Eligible medical expenditures can be claimed as a deduction, but to claim these deductions, total medical expenditures must exceed 7.5%-of-adjusted gross income (AGI) for 2018 and 10% starting in 2019.

What are considered medical expenses?

Eligible medical expenses are any costs incurred in the prevention or treatment of injury, disease, or in the case of dyslexia, learning disabilities. Medical expenses include health and dental insurance premiums (unless paid through a pre-tax plan), doctor and hospital visits, co-pays, and prescription drugs to name just a few. Generally, medical expenses do not include school tuition and related costs. That is unless the child has dyslexia, and then expenditures include items such as school tuition, transportation, lodging and meals, professional consultations, evaluations, and other forms of mental health treatment.

To increase the chance of success if challenged by the IRS, your doctor should recommend that special treatments, including schooling, are needed to address the learning disability. Additionally, the primary reason your child is attending the specific school is for medical care and not for behavior issues that might not qualify as learning disabilities.

Making sense of the AGI

Here’s a simple example that illustrates the 7.5%-of-adjusted gross income concept.

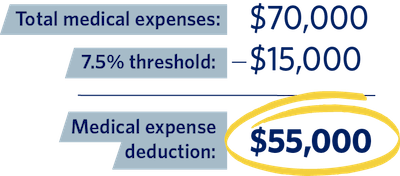

Assume that a married couple filing joint (MFJ) tax return reports $200,000 of adjusted gross income, $50,000 for school tuition for a private school for students with dyslexia, and other medical expenses related to the child with dyslexia totaling $20,000.

The first step is to determine the 7.5%-of-AGI threshold that must be reached before eligible medical expenses will result in a medical deduction. Therefore, the threshold amount is $15,000 ($200,000 x 7.5%). This means that expenses in excess of $15,000 can be deducted.

Can I claim medical expenses from prior years?

Good news, prior years are potentially not lost. If you paid for medical expenditures related to your child’s medical condition and did not claim (when you could have) a medical deduction, you might be able to file an amended tax return to correct the oversight. As in the current year, a case-by-case analysis needs to be done when going back to a prior year to determine if amending a return will, in fact, provide you with a greater tax benefit.

Next steps

If you prepare your own taxes and plan to claim the medical expense deduction, you need to fill out theIRS Form 1040 and attach Schedule A. If you work with an accountant or someone who prepares your taxes, be sure to mention that you may be eligible for the medical expense deduction.

Landmark360.org is not intending to provide tax advice. We recommend that each individual who thinks they qualify for a medical expense deduction consult a qualified tax advisor regarding their individual situations.

Author

Adam M. Domow earned his Certified Public Accountant (CPA) license in 2001 and an MBA with specialization in taxation from St. John’s University (NY).

Adam M. Domow CPA

[email protected]

www.domowcpa.com

Posted in the category Learning Disabilities.